Many people think choosing jewelry box inserts is just about looking high-end. However, for jewelry retail brands, these inserts are more akin to a set of small “display systems” and “risk control tools.”

In my conversations with leaders of many direct-to-consumer (DTC) brands and offline retail teams, I found they don’t get hung up on the question of “whether velvet is more high-end or foam is more practical”. Instead, they focus on three key questions:

In this guide, we’ll put the “velvet vs foam” question back into real retail scenarios. We’ll clearly explain when jewelry box velvet inserts are more suitable and when foam inserts for jewelry boxes fit the needs better, in a way you can apply directly. We’ll also tell you what specification details you need to prepare in advance if you want custom jewelry box inserts. This way, you can get comparable and actionable quotes and samples.

If you think of a jewelry gift box as a “mini display cabinet”, a jewelry box insert is the display system inside the cabinet.

They are not just simple fillers, but a structure that fixes positions, protects surfaces, and guides visual focus.

The secret behind the “neat, three-dimensional arrangement of jewelry when the box is opened” that you see in retail stores lies in the groove design and material selection of the insert.

When communicating samples with partner brands, we remind them to check the fit, flexibility, and display stability of the inserts.

Take the same ring groove, for example: if the opening is a bit wide, the ring will tip over after multiple try-ons in the store; but if the insert is too hard or thick, it will be squeezed when the box is closed. Over time, this pressure will leave marks.

The value of all inserts is more than just looking good—they also determine your future maintenance costs, rework rates, and restocking consistency.

In the dual model of retail and DTC, inserts serve at least four functions. You can use them for a quick self-check:

Many brands spend most of their budget on the outer box. But the moment consumers open the box, what really catches their attention is the touch and neatness.

Velvet jewelry box inserts usually deliver a more premium touch and sharper color contrast. However, foam inserts for jewelry boxes have advantages in fixation and impact resistance.

The key is not which insert is better, but to ensure consistent store displays, transportation conditions, and unboxing experiences under the same set of standards.

Professional tip: If you have multiple stores or need frequent restocking, clearly specify the insert color, surface touch, and slot size in your product specifications. In addition, ask suppliers to provide color swatches or samples from the same batch for comparison. The goal is not perfection, but to reduce hidden losses caused by “this batch looks different”.

Choosing the wrong insert usually leads to three common types of losses, which often do not appear immediately in the first batch of products:

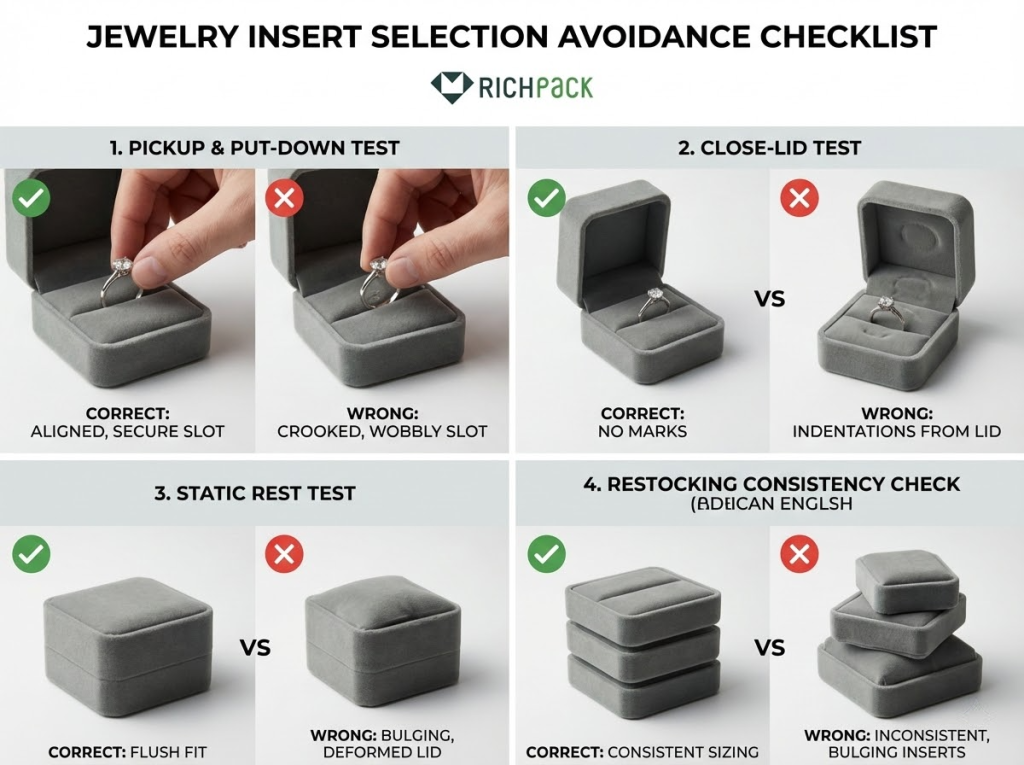

To control risks early, we recommend a 30-minute store simulation test at the sample stage: ask colleagues to pick up and put down the product repeatedly, and test the fit 20 to 30 times. Then check under the light if the product tips over, leaves marks easily, or collects dust quickly. This simple step is highly effective in screening out unsuitable inserts.

When choosing a retail solution for jewelry boxes, you can first break down the “insert” decision into two questions:

What material to use, and how to design the structure to hold the jewelry.

Although they are all called “jewelry box inserts”, some focus on touch and display effect, while others prioritize fixation and impact resistance. Choosing the wrong one leads to hidden costs, such as improper slots, hard-to-remove indentations, and unstable quality across batches.

We use a simple method in the sample testing phase: ask colleagues to place the sample under the counter light, then take it out and put it back 20 to 30 times. Then quickly check for tipping, scratches, or dust accumulation.

This step quickly eliminates materials or structures that are not suitable for frequent operation in retail scenarios, and also helps you decide later whether to use standard trays or custom jewelry box inserts.

Velvet jewelry box inserts make jewelry feel like it’s on a stage. They excel in soft touch and sharp color contrast, making them ideal for retail displays that need to highlight a premium texture and gifting atmosphere.

But there are practical issues in physical store operations. Velvet attracts dust more easily and shows fingerprints clearly. You must factor in the cost of daily cleaning and display maintenance into your operating expenses in advance.

Actionable tips:

The core value of foam inserts for jewelry boxes is fixation and adaptability. They are often used in slot-in and die-cut structures, and can hold rings, earrings, and necklace clasps more securely. They perform well in retail scenarios where jewelry is picked up frequently, or transportation protection is needed.

Common issues with foam inserts relate to density and resilience. Improper density can cause compression set or loose slots.

Actionable tips:

Paper inserts focus on lightweight display and cost control. They are often used in cardboard stands, foldable structures, or slotted cardboard. Their advantages include lower cost and a better sustainable image, making them suitable for fast-turnover products, promotional sets, or lightweight jewelry. But their drawbacks are equally obvious, such as limited structural strength—they deform easily and reduce perceived quality when used for frequent try-ons or heavy jewelry.

Actionable tips:

Paper-plastic structures are usually used in scenarios that require firmer fixation but want to be lighter and cheaper than all-plastic materials. Such structures often use partial plastic components to provide clamping positions, with paper materials for support and display.

For the retail industry, the value of paper-plastic structures lies in stable structure and balanced cost, but there are risks of assembly tolerances and appearance consistency issues.

Actionable tips:

Blister inserts are common in retail scenarios that require secure fixation, anti-theft, and shatter resistance. They work particularly well for small, high-value SKUs or products that need standardized display.

Blister inserts have the advantages of stable structure and precise positioning, but they are usually less high-end than velvet and produce more obvious reflections under strong light, which affects the visual effect.

Actionable tips:

EVA materials follow the principle of strong support and shape stability. They are often used in fixed clips or trays that need a sturdy structure, and have significant advantages in compression resistance and shape retention, making them suitable for complex structures or long-term display scenarios. When putting them into practical use, attention should be paid to surface treatment—different laminating or flocking processes greatly affect the touch and visual effect of the product.

Actionable tips:

Sponge is more like a soft filler. It is ideal for storing lightweight jewelry or providing temporary protection. But for long-term retail display or frequent handling, the shape change and resilience of the sponge are unpredictable. A common problem is that it “looks soft but has poor stability”—jewelry may sink into the sponge, resulting in a less three-dimensional display effect.

Actionable tips:

Leather or faux leather inserts have two key advantages: a high-end appearance and stain resistance. Store staff can maintain them more easily, and they are also suitable for product lines aimed at strengthening brand image.

However, there are potential risks. First, batch consistency can be an issue—differences in texture, luster, and touch may be greater across batches. Second, some faux leathers may produce odors in enclosed spaces.

Actionable tips:

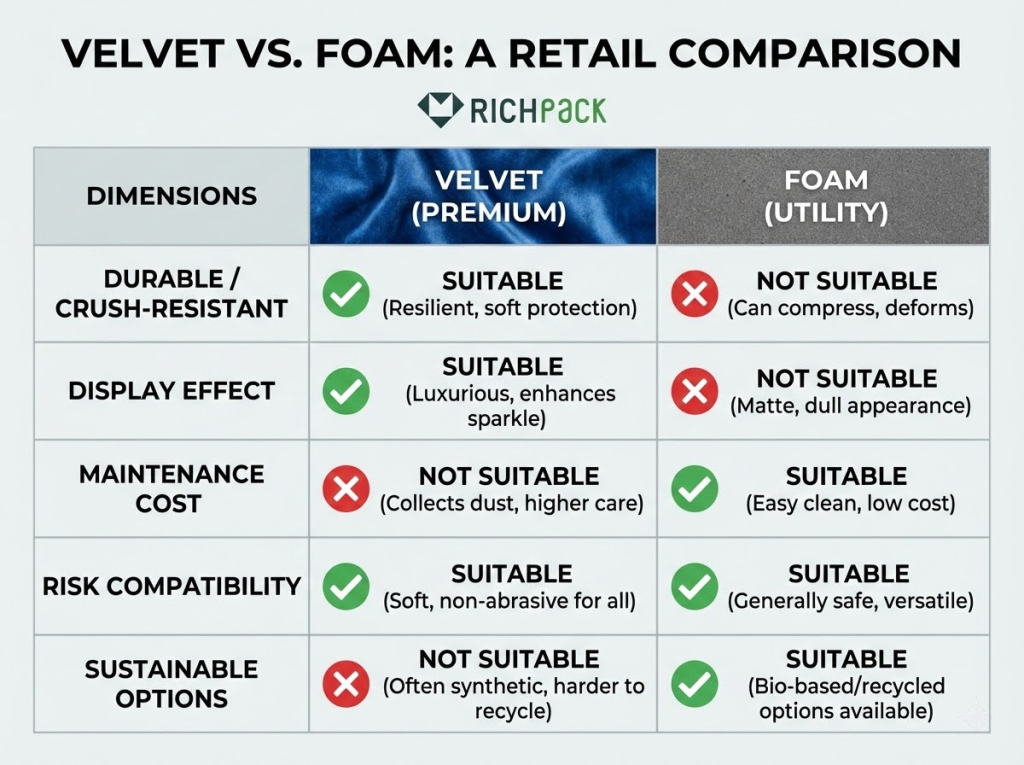

In retail scenarios, choosing between velvet and foam is rarely a matter of style preference. In fact, it’s a choice about operations and risk management.

You need a material that looks good under store lighting, stays tidy after customer try-ons, is easy to maintain in the store, and has no issues with restocking.

From our experience, if you set comparison criteria based on practical operability, most teams can narrow down the options to 1-2 types on the same day for sampling and testing.

To help you make a decision faster, I recommend using the following store-ready comparison table for evaluation. You don’t have to get everything perfect at once, but you should at least identify potential risks that could lead to rework or reputational damage in advance.

Durability is not about how soft a material feels. In retail scenarios, it depends on two practical factors: frequent handling and long-term pressure.

After frequent friction, velvet is more prone to pilling or indentations. Foam materials are more likely to collapse, have loose slots, or suffer permanent compression set if the density is not suitable.

If making ring inserts for jewelry boxes, it is recommended to add a small test to the sample testing process: pick up and put down the ring 20 to 30 times, then let it stand for 1 hour, then check if the insert tips over, leaves marks, and rebounds properly.

Actionable tips:

Velvet has a key advantage: visual atmosphere. Under warm or spot lighting, it presents a more high-end texture and better contrast, making it perfect for gift packaging or displaying high-priced products.

Foam, on the other hand, excels in structural support—it keeps rings and earrings upright and neat. It performs especially well when you need all exhibits to be placed at the same angle, holding them firmly in place.

You can break down “looking good” into three checkable points: first, how the material’s color appears under store lighting; second, whether it makes your products stand out; third, whether the display remains neat when viewed from different angles.

Actionable tips:

Many teams only look at the unit price, but the real cost comes from three later aspects: maintenance, rework, and returns.

Velvet may require more labor for daily cleaning and appearance maintenance. For foam, if the density, die-cut structure, or tolerance settings are improper, rework costs are very direct. You can calculate costs using repeatable standards, but remember that unit cost is just the starting point—what you really need to focus on is the operating hours per 1000 boxes and the failure rate.

Actionable tips (recommended to add to internal selection list):

The biggest concern in the retail industry is problems that arise after product launch. Common risks of velvet include dust accumulation, pilling, and uneven fading, while foam risks include odor release and issues related to long-term storage.

A situation check is needed here: if your products are mainly silver or gold-plated items that customers often store for a long time, you should add “whether rust-proof materials or paper are needed” to your evaluation items. If your products are mainly fast-turnover, short-cycle gifts, the priority of such risks can be lowered.

Actionable tips:

If you are building a brand story around sustainability, it is recommended to treat sustainable materials as scenario-specific alternatives rather than forcing their use across all products.

For SKUs that are lightweight, have relatively simple structures, and do not require ultra-high touch quality, molded fiber and FSC-certified cardboard are more suitable. For high-frequency trial products or high-priced gifts, velvet or foam may still be needed to ensure a premium touch and stability.

Sustainability also involves operational considerations: can products be restocked stably? Are they prone to moisture damage or deformation? Will they affect display neatness?

Actionable tips:

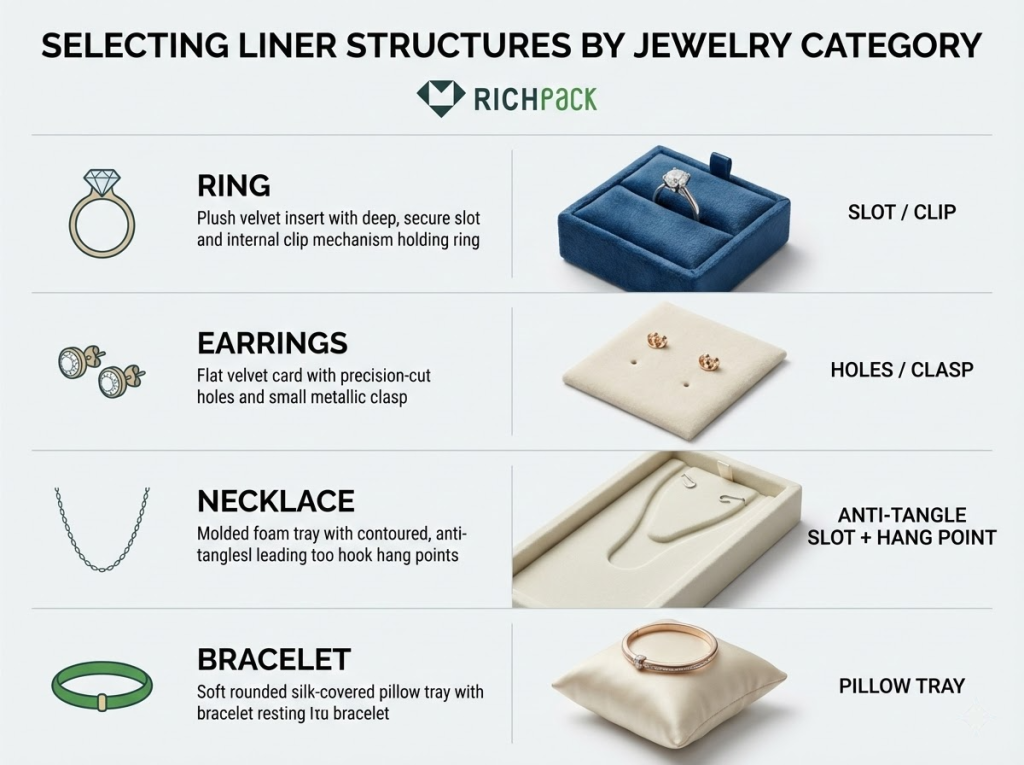

If you choose jewelry inserts only based on how good the material looks, you will likely encounter problems when using them in stores: rings may tip over, earring posts may get lost, necklaces may tangle, and box lids may not close properly.

These problems all stem from two key factors: the shape of the jewelry and the available space inside the jewelry box.

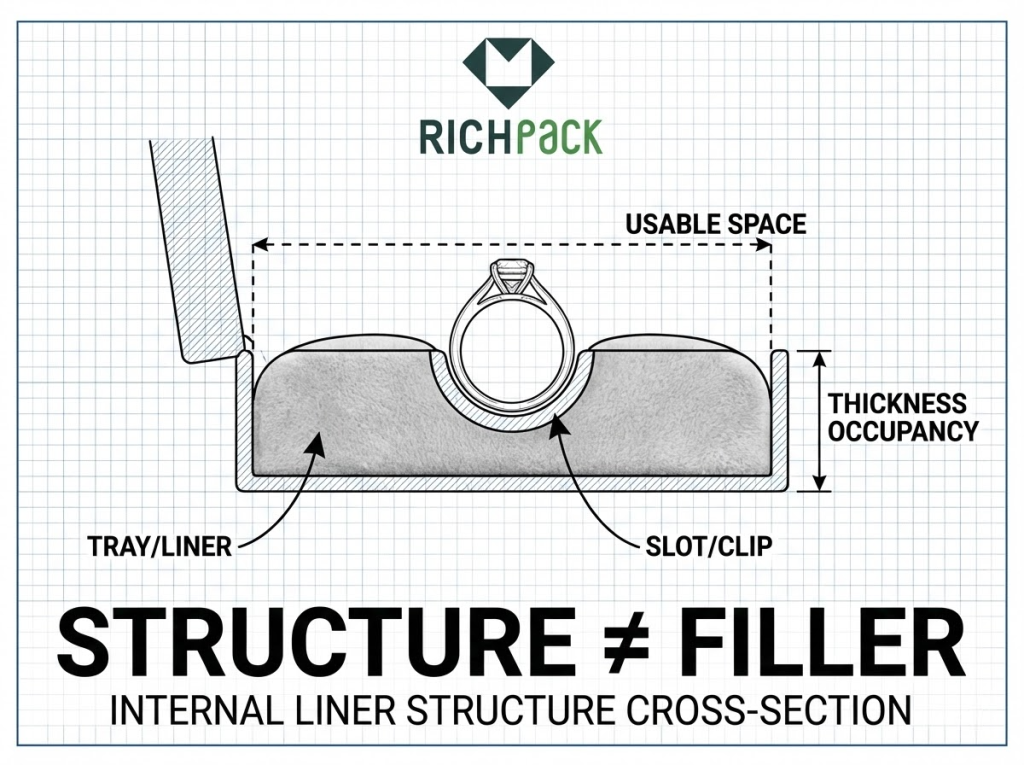

I recommend making decisions in this order: jewelry type → insert structure → size → material. Finalize the structure first, then decide whether to use foam or velvet.

We often conduct a reverse check during the sample production stage: first, place the jewelry in the planned groove, then close the box lid, and finally shake the box gently. If you notice any of the following—obvious shaking of the jewelry, squeezing of inlaid parts, or inconvenience in handling the jewelry—the insert is likely to have structural or thickness issues, which even the most expensive materials can’t fix later.

For brands that need custom inserts, write these pass/fail standards into the specification sheet to avoid qualified samples but unqualified mass-produced products.

The key to jewelry box ring inserts is more than just having slots—the slots must hold the ring at a stable angle, preventing tilting, falling, and squeezing.

During frequent in-store try-ons, loose slots will make the ring lie flat, while overly tight slots may scratch the ring or get stuck during handling. Die-cut foam is usually easier to control for tightness. Velvet surfaces look more high-end, but the slot structure and elasticity still need to be checked.

Practical tips:

The most common problems with earrings are lost earring posts and improper hole size. When retail staff handle earrings frequently, overly tight holes can bend the posts, while loose holes cause the earrings to shake or even fall off.

For stud earrings, design the hole size and earring back position together. For drop earrings, use T-shaped stands or snap-on structures to create a more three-dimensional display and reduce tangling.

Actionable tips:

Almost all necklace-related problems boil down to one word: tangling.

Chain necklaces work better with anti-tangling grooves, hook points, or pocket designs that provide a fixed path for the chain.

If your e-commerce business needs to ship necklaces, use foam or more sturdy internal supports to reduce chain shaking during transportation. If your necklaces are mainly displayed in physical stores, velvet can enhance the touch experience, but you still need to fix the hanging points and chain placement path.

Practical tips:

Bracelets, bangles, and watches all have one common requirement: they must maintain their shape.

Pillow-shaped inserts are a common solution, but hardness is a key consideration—too soft and the insert collapses; too hard, and it leaves indentations or prevents the box from closing properly.

In retail stores, customers try on these items frequently, so the feel of handling them is also crucial. Poor handling will make staff unconsciously reduce the number of try-ons, which affects sales.

Actionable tips:

When you need to handle multiple SKUs, adjust displays frequently, or your stores require fast new product launches, modular tray/drawer insert systems operate more efficiently.

The value of such systems is not in presenting a high-end appearance at once, but in turning merchandise display and restocking into standardized processes—speeding up product replacement, inventory replenishment, and stock checking.

For procurement managers, these systems also reduce cost fluctuations caused by the need for custom solutions for every new product launch.

Actionable tips:

Size issues are the most common cause of failures, typically manifesting as “looking almost the same but not fitting actually”.

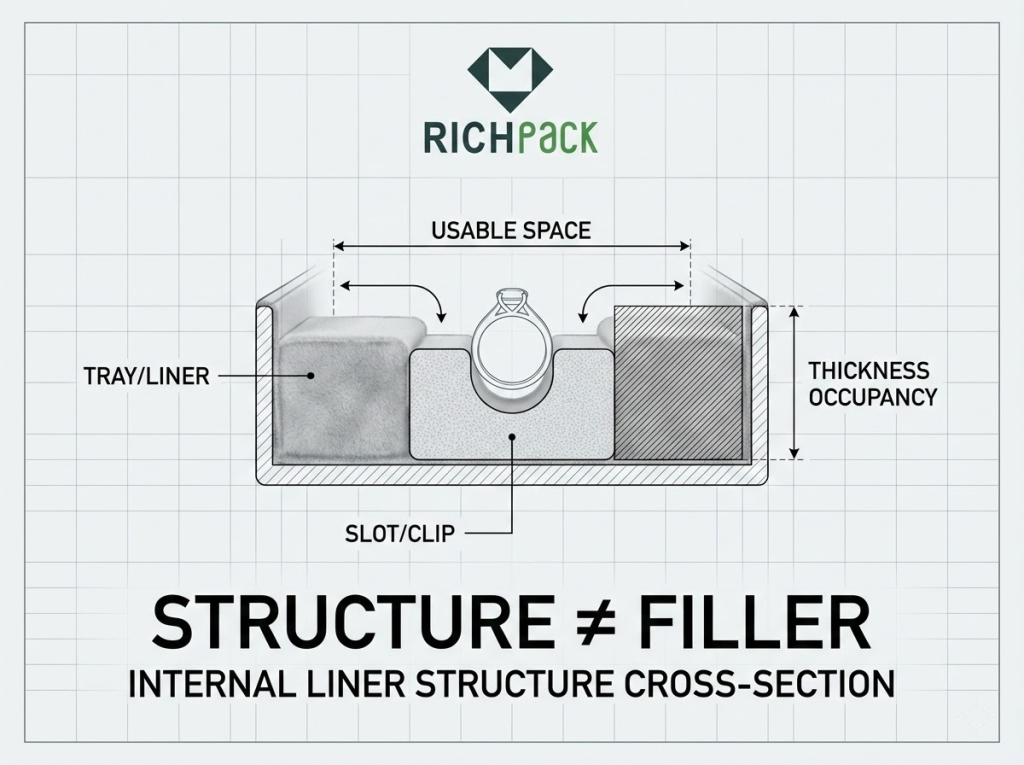

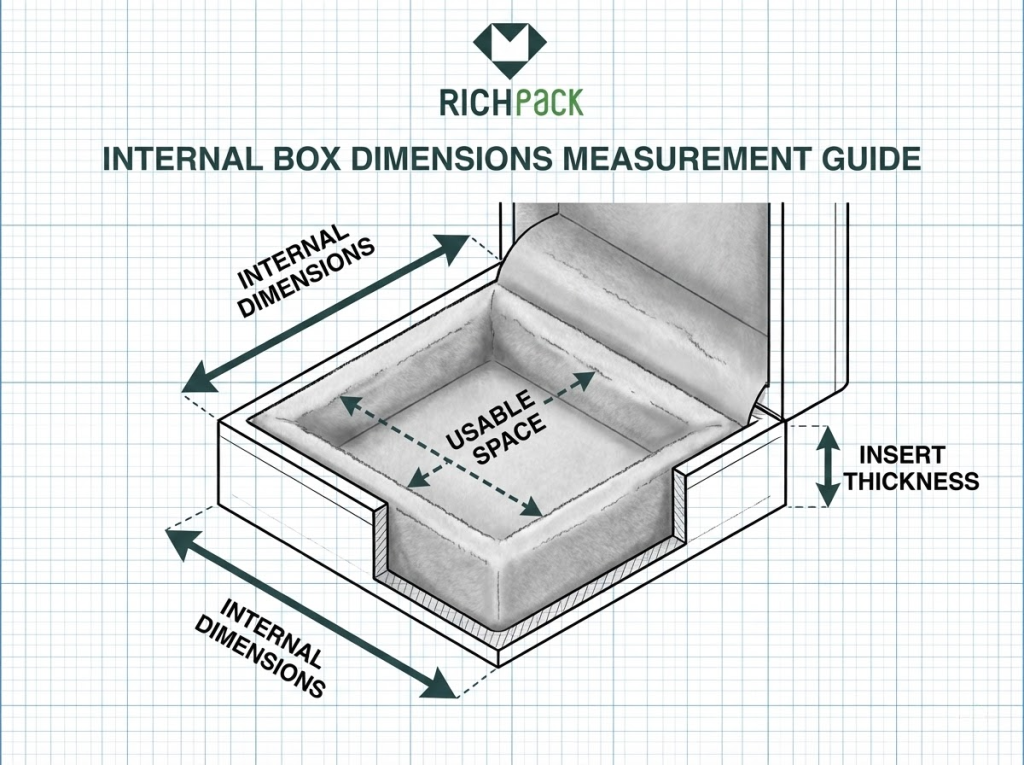

To solve this problem, you need to distinguish three concepts: internal dimensions, usable space, and insert thickness.

For the same box, a 2-millimeter increase in insert thickness can completely change the pressure when the box is closed. In addition, different suppliers have different understandings of tolerances, so boxes marked with the same specifications may not be interchangeable.

Actionable tips (recommend creating a one-page specification sheet):

People often underestimate the importance of internal support structures for products, and the reason is simple: samples may all look similar at first glance.

But once in the retail stage—with frequent try-ons, cross-store restocking, and simultaneous production across batches—hidden costs start to emerge, including rework, additional sampling, customer complaints, and inconsistent display effects.

I find these problems in brand evaluations almost every quarter. Avoiding just three or four of them will greatly increase your chances of choosing the right internal support structure.

I recommend using these problems as a checklist, with corresponding test methods for each. Spending an extra 30 minutes verifying during the sampling stage is much cheaper than incurring costs to correct issues after mass production.

Many teams fall in love with the texture of velvet at first sight and immediately choose velvet jewelry box inserts.

But the problem is: retail stores are not photo studios—there is dust, hand sweat, repeated touching, and frequent restocking.

Choosing only based on appearance often results in “looking great the first week but starting to look old from the second week”, forcing the display team to spend more time and energy on maintenance.

Actionable tips:

Foam inserts for jewelry boxes are not always better when softer. Low density makes grooves loose and causes jewelry to sink, while high density makes jewelry difficult to handle—your fingers may even get stuck. It may also squeeze the inlaid parts of the jewelry when closing the box.

There is a more hidden problem: compression set, which cannot be found immediately on samples and only appears after the sample has been placed for a period of time.

When making samples, I always do a simple test: pick up and put down a ring in the corresponding groove 20 to 30 times in a row, then let it stand for 1 hour and check the foam’s resilience. If obvious dents or crooked grooves appear, the foam density or structure needs to be adjusted—this is especially important for ring inserts for jewelry boxes due to their high frequency of use.

Actionable tips:

You usually can’t tell if an insert is too thick just by looking at it. Instead, the thickness only becomes apparent from the pressure and deformation when closing the box. Once the insert thickness exceeds the usable space inside the box, various problems arise, such as a bulging lid, loose magnetic clasp, deformed jewelry due to squeezing, and increased displacement during transportation.

Most brand reworks later are due to structures occupying unnecessary space.

Actionable tips:

This is a typical case of “qualified samples but unqualified mass production”. Even with the same size label, tolerances exist across different factories and production batches. Combined with differences in material resilience, this leads to unstable assembly of products with the same specifications.

This problem becomes more serious during peak seasons with restocking for multiple stores or simultaneous production across multiple lines, causing inconsistent displays and increased communication costs.

Actionable tips:

Custom jewelry box inserts definitely create a differentiated advantage, but early deep customization can easily trap you in a predicament of high MOQs, long lead times, and difficult restocking. For brands that launch new products frequently and have fast-changing SKUs, this directly increases inventory and cash flow pressure.

More practically, you push up costs before verifying if the store really needs such a complex structure.

Actionable tips:

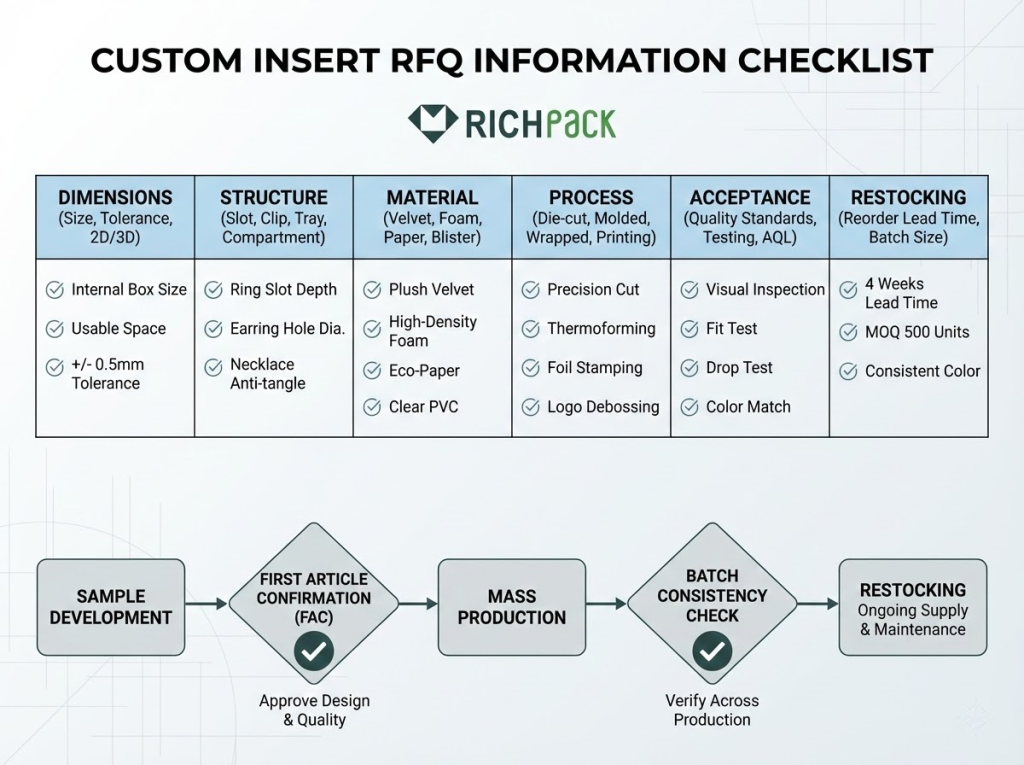

On the surface, custom jewelry box inserts may seem as simple as adding a logo and choosing a color. But to do it well, the key lies in three points: can you clearly state your needs? Can you address potential risks in advance? Can you set clear standards for restocking?

Many brands struggle at this step—not because suppliers lack professional capabilities, but because the brand provides incomplete information, leading to non-comparable quotes, non-reproducible samples, and inconsistent quality across mass production batches. Standardizing this work will save a lot of communication costs when launching new products or restocking in the future.

The method I use most in projects is to first lock in the variables that must remain stable, then iteratively adjust the optimizable variables. For example, inner box size, tolerance range, number of slots, and structure type must be fixed, while surface material, color, and some process details can be fine-tuned in the second round of sampling.

This method greatly reduces the probability of rework and helps transform jewelry box inserts from handcrafted custom products into supply chain standard products that can be mass-produced.

The first inquiry email you send determines whether you receive comparable quotes or a bunch of mismatched solutions, especially when you’re unsure whether to choose velvet or foam. You must state the usage scenario and acceptance standards in the email; suppliers can only guess based on experience.

You can directly copy the following list into your RFQ.

Recommended mandatory items:

Professional tip: When encountering issues related to material safety, odor/VOCs, wear resistance, or compression rebound, ask suppliers for TDS or third-party test documents.

There can be many customization options, but those truly valuable for the retail industry are usually divided into three categories: structure, surface, and brand identity.

Structure determines placement stability; surface determines perceived value; brand identity determines style consistency. If you want to maintain a unified store display style, it is recommended to get the structure right first, then optimize surface and identity details—otherwise, you may end up with products that are all show and no go.

Common controllable options in order of priority:

Practical tip: Make at least two groups of samples for comparison in the sampling stage—one with the same structure but different surface materials, and the other with the same surface material but different structures. This allows you to quickly determine if the problem is with the structure or the material.

MOQs themselves are not a bad thing. The real risk is being forced to stock up more inventory due to MOQs while SKUs change, which increases inventory and cash flow pressure.

For DTC brands or multi-store retailers that launch new products frequently, I recommend including restock planning in the early stage of the project. You need to determine which parts to standardize, which to replace, and how to maintain appearance consistency during restocking.

Actionable tips:

When evaluating suppliers, don’t just ask “can you make it?”—ask “can you supply it stably?” This is especially important for parts like jewelry box inserts, which have high requirements for tolerances, touch, and inter-batch consistency. For such parts, stability is more important than fancy functions.

I usually use a 5-point checklist to quickly screen suppliers, which helps me eliminate 60% of mismatched suppliers in the first communication.

A reusable 5-point checklist for buyers:

Professional tip: For projects requiring strict brand consistency, good store experience, and stable restocking, choosing a strategic packaging partner with end-to-end service capabilities often helps turn standards into actions.

There is no absolutely better choice, only the one more suitable for your retail scenario. Velvet jewelry box inserts excel in enhancing texture and contrast, while foam inserts for jewelry boxes are better at converting structural stability, resilience, and batch consistency into controllable standards. The real deciding factors usually include three points: whether your store has high-frequency try-ons, fast restocking needs, and the maintenance cost you can bear.

Quick selection checklist:

When testing samples in stores, I do a simple check: take the same box and repeat the take-out, close-lid, open action 30 times, then check if the slot loosens, the surface pills, or the jewelry shifts. If it fails this test, talking about high-end texture later is meaningless.

Ring inserts for jewelry boxes face two main problems: being too soft, causing the ring to sink or tip over, or being too hard, making the ring difficult to insert or remove, and potentially squeezing the inlaid parts.

Judging only by touch is inaccurate because the resilience and compression set of foam usually only appear after repeated handling and standing for a period of time.

A more reliable method is gradient sampling: make 2 to 3 samples of different densities or hardness for the same design, ask store staff or your team to test them with the same operation method, and select the one with the best stability.

You can adopt the following testing steps:

If concerned about odor or chemical release, ask suppliers for TDS or third-party test documents and write this requirement into your inspection terms.

Yes, especially in bright, high-traffic environments where dust and lint are more noticeable. But this does not mean velvet is unsuitable for retail stores—it just means you need to add maintenance steps to daily operations: who cleans, how often, with what tools, and will it affect display efficiency?

Many stores switch to other materials later, not because velvet is not high-end enough, but because they underestimate maintenance costs.

Common low-cost maintenance methods used by stores:

If you run a chain of multiple stores, write the cleaning frequency and tools used into the SOP. Without such regulations, the same packaging will look like products of different quality levels in different stores.

Foam inserts directly take up space inside the box, usually more than you think. You need to understand three key terms: internal dimensions, usable space, and insert thickness.

For the same box, even a 2 to 3 millimeter increase in insert thickness can cause problems—it may change the pressure when closing the lid, leading to unstable magnetic clasp closure and even squeezing and deforming the jewelry. These problems worsen during in-store try-ons and transportation, ultimately leading to customer complaints.

I recommend using the reverse calculation method to choose box types: first, determine the height and safety margin required for jewelry display, then reverse calculate the required usable depth, and finally select the appropriate box type and insert structure.

You can quickly check the following key points:

Many people struggle to choose between velvet and foam. In fact, there’s only one real decision to make: do you want something that looks more high-end, or something more durable for long-term use?

Velvet jewelry box inserts are better at enhancing unboxing texture and display atmosphere, while foam jewelry box inserts excel at converting stability, resilience, and batch consistency into controllable standards.

For retail scenarios, the best answer is usually not an either/or choice. Instead, you should combine the two based on the product’s try-on frequency, transportation method, and restocking cycle.

If you can only remember one method, I recommend the three-step decision-making method to reduce uncertainty:

When collaborating with procurement teams, I view insert selection as a supply chain risk management issue—not just a matter of aesthetic preference. Choosing the wrong insert turns subsequent rework, resampling, and store maintenance into hidden costs, with the most troublesome problem being “every batch of inserts looks different”.

Incorporating specification requirements, inspection steps and restocking standards into process norms is the real way to save the brand from trouble.

Just submit your email to get exclusive offers (reply within 12 hours)