Choosing the Right Hinged Box for Jewellery: A Comprehensive Guide

2024-11-29

The exponential growth of e-commerce, the non-negotiable demand for sustainability, and the elevation of packaging from a protective necessity to a primary brand asset. Within this broader landscape, the jewellery pouch—a flexible, tactile, and logistically efficient container—has emerged as a focal point of innovation. No longer merely a secondary accessory to the rigid box, the pouch now commands a significant share of the packaging market, favored for its versatility, lower shipping volumetric weight, and capacity to convey intimacy through texture.

This comprehensive research report provides an exhaustive analysis of the ten most influential and popular jewellery pouch companies operating on the global stage today. The selection of these ten entities is based on a rigorous evaluation of their market share, brand reputation, global distribution capabilities, innovation in material science, and their ability to service the diverse spectrum of the market—from independent artisans on Etsy to multinational luxury houses. The analysis synthesizes data from industry reports, supplier catalogs, and corporate profiles to construct a detailed picture of the competitive landscape.

The ascendancy of the jewellery pouch is inextricably linked to the economics of modern retail. As jewellery sales have migrated online, the unboxing experience has become the sole physical touchpoint between the brand and the consumer before the product is revealed. Rigid boxes, while protective, often incur higher dimensional weight charges in shipping—a critical factor for low-to-mid-range items where margins are thin. Flexible pouches offer a solution that is both luxurious and logistical: they compress for shipping, reducing carbon footprints and freight costs, while offering a sensory experience that rigid cardboard cannot replicate.

Furthermore, the Green Revolution in packaging has accelerated the shift toward reusable pouches. Unlike a paper box which is often discarded, a high-quality velvet, suede, or cotton pouch is frequently retained by the consumer for travel or storage, extending the brand’s visibility within the consumer’s life. This secondary life of the packaging is a powerful value-add that manufacturers are increasingly leveraging in their marketing pitches.

The market is distinctly stratified. At the apex, European manufacturers like Ch. Dahlinger offer couture packaging solutions—bespoke designs using proprietary synthetic leathers that mirror the trends of the Milan and Paris runways. In the middle tier, massive distributors like Noble Gift Packaging and Gunther Mele provide the logistical backbone for the industry, offering vast inventories of stock goods that can be customized and shipped within days. At the foundation, agile disruptors like Tiny Box Company and Westpack are democratizing access to professional-grade, sustainable packaging for the burgeoning maker economy. Additionally, manufacturing powerhouses like Richpack are bridging the gap between direct manufacturing and high-end design, offering scalable custom solutions for growing global brands.

This report dissects these strategies, offering a granular view of how each of the top ten companies creates value. It explores their operational histories, their material innovations—from Fairtrade cotton to Nappan leather—and their strategic outlooks for 2026 and beyond.

Before examining the corporate profiles, it is essential to understand the product itself. The jewellery pouch is a complex interplay of material science and consumer psychology. The research indicates that the choice of material is never arbitrary; it is a calculated decision to signal value.

The industry operates on a tactile hierarchy. At the entry level, Organza—a sheer, lightweight fabric—is the standard for volume retail. It offers visibility (the customer can see the product) and low cost, making it ubiquitous in the catalogs of generalist suppliers. Moving up the value chain, Cotton and Linen signal eco-consciousness and natural luxury.

At the luxury tier, the industry relies on Velvet, Suede, and high-grade Leatherette. These materials function as light-absorbing backgrounds that enhance the sparkle of gemstones and precious metals. Companies have pushed this further with proprietary materials like Nappan (a sophisticated synthetic leather) and Microfiber, which double as cleaning cloths, adding functional value to the aesthetic form.

Customization capabilities define the competitive edge of these suppliers. The ability to hot-stamp a logo in gold foil onto a velvet pouch is a standard requirement. However, the leaders differentiate themselves through the ease of this process. Some suppliers archive client clichés (printing plates) to eliminate setup costs for repeat orders, reducing the friction of B2B procurement. Others offer digital printing services that allow for full-color logos, a technological leap that caters to modern branding requirements.

Headquarters: Holstebro, Denmark

Primary Market Scope: Europe, Global

Strategic Classification: The High-Volume Brand Builder

Westpack, established in 1963, stands as a paragon of Scandinavian efficiency and design. Based in Holstebro, Denmark, the company has successfully transitioned from a traditional wholesaler to a modern Danish wholesaler that blends high-volume capacity with the aesthetic sensibilities of Nordic design. Their operational motto, The One-Stop-Shop, reflects a strategic ambition to capture the entire peripheral spend of a jeweller.

Westpack’s pouch offering is characterized by a rigorous categorization of materials, catering to every price point while pushing the industry toward sustainability.

Westpack’s greatest strength lies in its digital-first approach to customization. They have demystified the printing process. The cliché system—where the metal plate used for hot stamping is stored indefinitely for the client—removes the setup cost barrier for subsequent orders, locking in customer loyalty.

Westpack dominates the European market by balancing quality with speed. Their Bulk Buy options offer significant discounts for larger orders, yet they maintain low MOQs for smaller boutiques, effectively servicing the entire pyramid of retail.

Headquarters: Fuzhou, China

Primary Market Scope: Global Export, High-Volume Retail

Strategic Classification: The Global Customization Powerhouse

Richpack, a company that epitomizes the modern capability of Chinese manufacturing. With over 15 years of operational history, Richpack has evolved from a production facility into a comprehensive packaging solution provider. Based in Fuzhou, they have successfully bridged the gap between low-cost manufacturing and high-end design, positioning themselves as a strategic partner for global brands scaling their operations. Their philosophy centers on offering elegant security, combining protective functionality with aesthetic sophistication.

Richpack’s manufacturing capacity allows for an exceptionally wide range of material options, servicing both the high-volume and luxury segments.

Richpack packaging is the ideal partner for brands that have outgrown stock packaging and require 10,000+ units of fully bespoke designs. By offering direct access to the factory floor, they eliminate the middleman, providing significant margin advantages for jewellers while maintaining high standards of quality control and design flexibility.

Headquarters: Comun Nuovo (Bergamo), Italy

Primary Market Scope: Italy, USA, Global Luxury

Strategic Classification: The Fashion House of Packaging

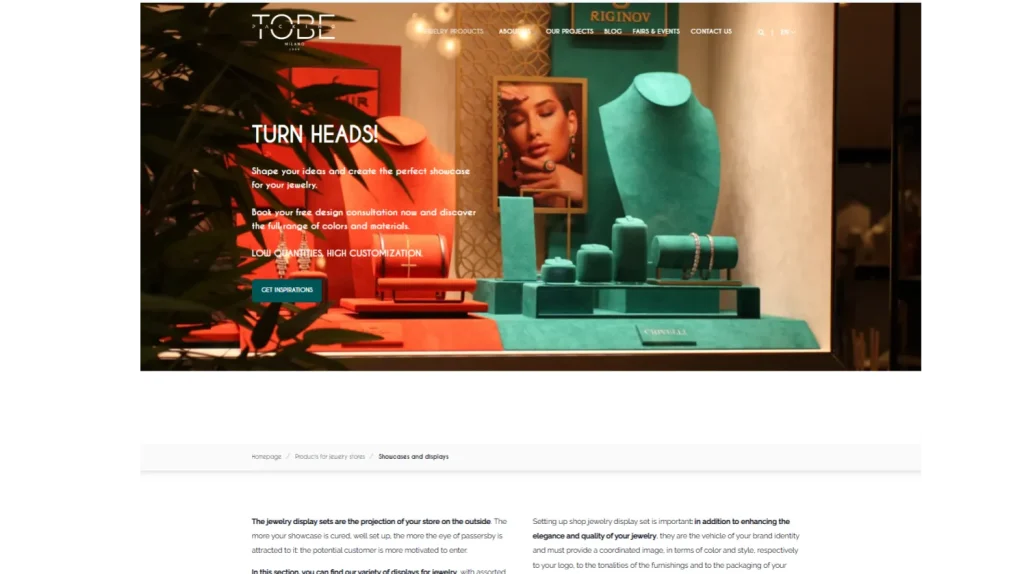

Founded in 1999, To Be Packing brings the flair of Italian fashion to the packaging world. Based in Lombardy, they operate not just as a factory, but as a design house. Their presence is physical and experiential, with showrooms in Milan and New York that allow clients to touch and feel the materials in a boutique setting.

To Be Packing pushes the boundaries of what a jewellery pouch can be made of.

To Be Packing is the choice for the Aesthete. They serve brands that view packaging as a marketing expense rather than a logistical one. Their strong foothold in the US market, supported by their New York showroom, allows them to bridge the gap between Italian craftsmanship and American retail scale.

Headquarters: Brantford, Ontario (Canada) / Buffalo, New York (USA)

Primary Market Scope: North America

Strategic Classification: The North American Heritage Giant

Tracing its roots back to 1857, Gunther Mele is one of the oldest continuing operating packaging companies in North America. This longevity has allowed it to build an unparalleled network of relationships with independent jewellers across Canada and the United States. With dual headquarters, Gunther Mele operates as a cross-border logistics powerhouse, insulating its clients from the friction of international customs.

Gunther Mele’s product strategy is one of universality; they aim to have a solution for every possible need.

The company emphasizes immediate shipment for stock items, a critical capability for North American retailers who often operate with Just-in-Time inventory practices. Their custom printing service promises a competitive turnaround for domestic customization.

Gunther Mele is the safe pair of hands for the North American industry. They may not lead with the avant-garde fashion designs of the Italians, but their reliability, massive in-stock inventory, and deep understanding of the practical needs of the main-street jeweller make them a dominant incumbent.

Headquarters: Montreal, Canada (Global hubs in UK, USA, EU)

Primary Market Scope: Global

Strategic Classification: The Logistical Accelerator

Noble Gift Packaging describes itself as a high-growth eCommerce company, a moniker that reveals its modern, aggressive approach to the market. While family-owned, it operates with the scale of a multinational corporation. Its headquarters are in Montreal, but its operational footprint spans the globe, with major distribution centers in New Jersey (USA), London (UK), and across Europe.

With over 25,000 products in stock, Noble’s catalog is exhaustive.

Noble competes on speed and accessibility. Their promise to answer calls within 30 seconds and their investment in a state-of-the-art customer service team addresses a common pain point in B2B sourcing.

Noble is the preferred supplier for brands that require consistency across multiple territories. A brand with stores in London, New York, and Toronto can use Noble to ensure that their packaging is identical in every location.

Headquarters: Lahr, Germany

Primary Market Scope: Europe, Luxury Global

Strategic Classification: The Heritage Perfectionist

Ch. Dahlinger represents the gold standard of European manufacturing. Founded in 1871, this fifth-generation family business is steeped in the tradition of the Black Forest region. Unlike the mass-market distributors, Dahlinger focuses on the upper echelon of the market—watchmakers, fine jewellers, and luxury brands that require packaging to match high-four-figure price tags.

Dahlinger’s product lines are fewer in number but higher in execution quality.

Dahlinger operates a Manufactory and a design studio, emphasizing bespoke creation over stock picking. They offer a One box – many possibilities approach, customizing standard bases to unique client specifications.

Dahlinger is the supplier for the Old World luxury market and the new brands that aspire to it. Their pricing reflects this; they are not the low-cost leader, but the quality leader.

Headquarters: Albuquerque, New Mexico, USA

Primary Market Scope: North America, Global

Strategic Classification: The Integrated Ecosystem

Rio Grande is a titan in the jewellery industry, often serving as the primary source for everything from raw gold casting grain to the final gift box. A Berkshire Hathaway company, Rio Grande operates with immense financial stability and logistical capability. While they are a generalist supplier, their packaging division is massive.

Rio Grande’s packaging selection is curated for the professional bench jeweller and the independent artist.

Rio Grande is the Educator and Supplier. They provide extensive content on how to pack and present jewellery. For the small-to-medium jeweller in the US, Rio Grande is the default starting point.

Headquarters: Lafayette, Louisiana, USA

Primary Market Scope: North America

Strategic Classification: The Customization Tech Leader

Stuller is the other half of the North American duopoly (alongside Rio Grande) for jewellery supplies. However, Stuller distinguishes itself with a fierce focus on Just-in-Time customization and digital integration. They view packaging as a customizable component of the jeweller’s brand identity.

Stuller’s offering is vast, structured around key collections like Linen Pouch, Soft Suede Pouch, and Embroidered Satin Pouch.

Stuller is the Technologist’s Choice. Their ability to imprint logos digitally and their clear, tiered pricing structure for customization make them the preferred partner for jewellers who manage their businesses with precision.

Headquarters: Uckfield (East Sussex), UK

Primary Market Scope: UK, Europe

Strategic Classification: The Ethical Disruptor

Founded in 2007 by Rachel Watkyn after a stint on the TV show Dragons’ Den, Tiny Box Company was born from a frustration with the lack of ethical packaging options. They have grown into a cult favorite in the UK, particularly among the maker community and independent boutiques. Their mission is explicitly environmental.

Tiny Box Company’s products are defined by their aesthetics and their ethics.

Tiny Box Company is the Soul of the Market. They appeal to the values-driven entrepreneur. While they may not have the industrial scale of Noble, their brand loyalty is fierce.

Headquarters: London/Essex, UK

Primary Market Scope: UK

Strategic Classification: The Resilient Heritage

Potters (London) Limited is a historic institution in the UK jewellery trade, with a lineage dating back to the 19th century. Recently, the business was acquired by Karina Krafts, creating a powerhouse of British heritage packaging. This merger preserved the Potters brand, which is synonymous with quality in the UK, while modernizing operations.

Potters serves the traditional high-street jeweller but has adapted to modern demands.

Potters/Karina Krafts is the Guardian of Tradition. They maintain the standards of the British trade. Their acquisition and survival strategy demonstrates the enduring value of trusted, local supplier relationships in an era of global anonymity.

The following section synthesizes the data to compare these top 10 players across critical axes: Material Innovation, Logistics, and Branding Capabilities.

| Company | HQ Location | Primary Market | Key Strength | Notable Innovation | Sustainability Level |

| Westpack | Denmark | Europe/Global | B2B Efficiency | Cliché Plate Storage | High (Fairtrade/Eco Mark) |

| Gunther Mele | Canada/USA | North America | Logistics/Stock | Organza Color Variety | Moderate |

| Noble Packaging | Canada/Global | Global | Speed/Scale | 25,000+ Stock Items | Moderate |

| Ch. Dahlinger | Germany | Luxury EU | Tactile Quality | Velour Look Material | Moderate (Longevity Focus) |

| Richpack | Organza Colour Variety | Global Export | Custom Manufacturing | Silk & PU Solutions | Moderate (Eco-materials) |

| Rio Grande | USA | North America | Integrated Supply | Translucent Soft Sleeve | Moderate |

| Stuller | USA | North America | Custom Tech | Digital Color Printing | Moderate |

| Tiny Box Co | UK | UK/Europe | Sustainability | Recycled Eco Aesthetics | Very High (Core Mission) |

| To Be Packing | Italy | High Fashion | Design/Trend | Nappan & Lycra | High (Material Tech) |

| Potters | UK | UK | Heritage | Eco Bundles | High (New Direction) |

A clear divergence exists in how these companies approach materials.

The Amazon effect has reached the B2B packaging world.

While currently dominated by material innovation, the next frontier is digital. Stuller’s investment in digital printing suggests a future where pouches could carry QR codes or NFC chips woven into the fabric, linking the physical package to a digital certificate of authenticity or a brand story video.

Sustainability is pushing the industry toward the Forever Pouch—packaging designed to never be thrown away. Companies like To Be Packing and Richpack are already marketing their pouches as travel accessories or functional storage. We anticipate a trend where high-end pouches feature more robust closures (zippers vs drawstrings) and internal organization (dividers) to encourage permanent retention by the consumer.

The Top 10 jewellery pouch companies are not merely vendors; they are strategic partners in the value chain. From the heritage workshops of Germany to the sustainable city hubs of Fuzhou and the digital platforms of Denmark, these companies shape how the world perceives value. As the market moves into 2026, the winners will be those who can seamlessly blend the tactile (soft, luxurious materials) with the technical (digital printing, fast logistics, sustainable certification). The pouch is small, but its impact on the global jewellery trade is immense.

Looking for a partner who already embodies this “Tactile + Technical” fusion? Richpack stands out by combining heritage-quality materials with the speed of digital printing and sustainable logistics. Don’t just adapt to the 2026 trend—lead it.

The MOQ varies significantly by supplier type. For “in-stock” items that are simply printed with a logo (hot stamped), suppliers like Gunther Mele and Westpack often allow orders as low as 100 units. However, for fully custom-manufactured pouches (specific size, unique fabric, or dye), manufacturers based in China like Richpack or Biben typically require an MOQ of 500 to 1,000 units to ensure production efficiency.

There is a distinct difference between customized stock and custom manufacturing.

Printed Stock: If you are ordering a standard pouch from a warehouse (e.g., Noble Packaging) and adding a foil logo, the lead time is typically 2 to 3 weeks.

Custom Manufacturing: If you require a unique shape or material woven from scratch, the lead time extends to 4 to 6 weeks, plus shipping time from the manufacturing hub (often Asia).

Standard fabrics like cotton or velvet do not inherently prevent tarnish. To protect silver, you should look for pouches treated with anti-tarnish agents or use specific materials like Microfiber, which is less abrasive and can be used for cleaning. Some suppliers, like Rio Grande, offer specialized solutions like the “Soft Sleeve” or recommend adding Intercept® Anti-Tarnish Tabs inside the pouch to chemically neutralize corrosive gases.

Traditionally, logo customization on pouches is done via Hot Stamping (foil), which is limited to one color (Gold, Silver, Black, etc.). However, modern suppliers like Stuller now offer Digital Printing services, which allow for full-color logos, gradients, and complex imagery that traditional methods cannot achieve.

es. The market has moved beyond vague claims of “natural” fibers. Companies like Tiny Box Company and Westpack now offer pouches made from Fairtrade Certified Cotton and RPET (Recycled Polyethylene Terephthalate). When sourcing sustainable pouches, it is advisable to look for specific certifications (like the “ECO” mark or FSC accreditation) rather than generic marketing terms.

The demand for customized packaging is growing fast. The global jewelry market is expected to see big growth. This makes jewelry bag pouches that are both stylish and practical more important than ever. Custom jewelry pouch bags are more than storage—they’re a brand statement. Discover four standout design ideas that blend style, function, and identity to elevate… Continue reading 2026 Top 10 Jewellery Pouch Manufacturers and Suppliers

35% of buyers in the luxury market are seeking personalized packaging including Dune Jewelry packaging. Dune Jewelry packaging design trends are ever-changing. And blindly implementing them for the sake of sheer trendiness can lead you to some pretty bad packaging design choices. Instead, use them as inspiration. Now let’s dive into this article. 1. What is Dune Jewelry? Before we dive into the trends,… Continue reading 2026 Top 10 Jewellery Pouch Manufacturers and Suppliers

When fashion influencer Lexi Monroe unboxed her $5,000 diamond tennis bracelet live for 200K followers, the gasps weren’t for the jewels—they were for the crushed velvet jewelry bag stamped with 24k gold foil. That’s the power of luxury jewelry bags done right! Forget heavy jewelry organizers—today’s winners use jewelry bags wholesale with genius touches like tarnish-proof… Continue reading 2026 Top 10 Jewellery Pouch Manufacturers and Suppliers

Adorable and Practical Travel Jewelry Case Mini – Keep Your Jewels Safe on Trips

View More

Cotton Jewelry Pouch | Eco-Friendly, Soft Storage for Your Precious Pieces

View More

Affordable Jewelry Bags Wholesale for Professional Packaging – High-Quality Wholesale Jewelry Bags for Retail and Gift Solutions

View MoreJust submit your email to get exclusive offers (reply within 12 hours)